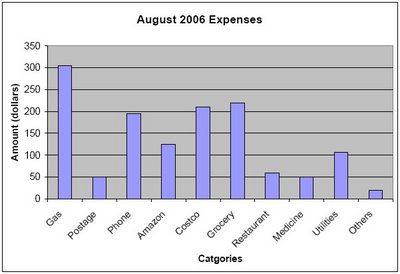

August 2006 Score Card -- Part I: Expenses

As the month of August has come to an end, it's time to see how I did in the past month.

The first item on the score card is the monthly expenses. This is the first time in a while that I kept a complete record of how we spent the money this month. Not included in the chart are $800 for the child care, $1635 mortgage, and those we invested in stocks/mutual funds/bonds. Otherwise, it's a complete picture.

Looking at the chart, the single biggest item is gas at more than $300. Both my wife and I have to comute about 30 miles every day and have to use the car in the weekend either to go shopping or take our daughter out. I don't see much save on this part. Good news is that the gas price has come back a bit recently. This could help to trim our monthly bill.

Actually, the only place I can see a cut is at Costco. We go to Costco every other week, mostly to buy orgainc milk and eggs for our daughter. However, every time we would also buy something else that are not considered essential or in need right away. Some are impulse buyings, some are nice to have. I guess I have to blame Costco for part of this. They just won't stop sending out all those coupons!

Oh, for the phone services. It's lindline, cell phone, and cable. It wouldn't be this high if I remembered to pay last month's cell bill. And the postages are for those items I sold on Amazon. As I only got a few items on sale now, this item probably will disappear, unless I can find profitable items to buy-and-sell.

I think we were pretty good last money. No a lot unnecessary spendings.

Categories: Finance, Savings,

Technorati tags: Networth, Personal finance, Savings

Digg this! |

Digg this! |

Add to deli.cio.us |

Add to deli.cio.us |

Yahoo

Yahoo