August 2006 Score Card -- Part III: Asset Allocation

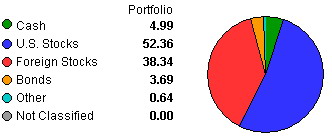

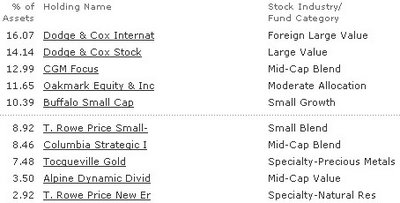

Morningstar instant X-ray shows that for our mutual fund portfolio, more than 52% are in US stocks as of August. Another big chunk is foreign stocks, which counts more 38%. The foreign stock part has got a little bigger than what I desire 30%, and the growth mainly came from investments in Dodge & Com International Stock (DODFX), which is the largest holding in the portfolio and has an accumulative gain of 72% since we purchased it three years ago. Some asset allocation suggests 20% in foreign stocks, which is much lower than our current holding. The reason I decide to go with a larger piece of foreign stocks is to catch the repaid growth of developing economies, as well as the steady growth of other meatured markets such as Frence, UK, and Japan.

Morningstar instant X-ray shows that for our mutual fund portfolio, more than 52% are in US stocks as of August. Another big chunk is foreign stocks, which counts more 38%. The foreign stock part has got a little bigger than what I desire 30%, and the growth mainly came from investments in Dodge & Com International Stock (DODFX), which is the largest holding in the portfolio and has an accumulative gain of 72% since we purchased it three years ago. Some asset allocation suggests 20% in foreign stocks, which is much lower than our current holding. The reason I decide to go with a larger piece of foreign stocks is to catch the repaid growth of developing economies, as well as the steady growth of other meatured markets such as Frence, UK, and Japan.

I sold our only bond mutual fund early this year, but kept the I-Bond and continue to add every month. Now all our bond mutual funds are in tax sheltered accounts.

Categories: Investing, Networth, Finance, Funds

Technorati tags: Asset allocation, Investing, Mutual funds, Stocks

Digg this! |

Digg this! |

Add to deli.cio.us |

Add to deli.cio.us |

Yahoo

Yahoo

0 Comments:

Post a Comment

<< Home