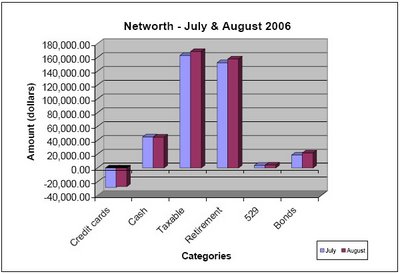

August 2006 Score Card -- Part II: Networth

I have already summarized our expenses in August. Now it's the networth's turn to appear on the score card. Not included in the plot are 1) car loan (as well as the values of our cars) and 2) mortgage (as well as the value of our house). The main reason of not including these two items in the networth calculation is that I am not sure the market values of the cars and the house. Adding them to the equation may skew the result and give us a inflated number. Overall, the net change from July is $15,055, or about 4.25%.

I have already summarized our expenses in August. Now it's the networth's turn to appear on the score card. Not included in the plot are 1) car loan (as well as the values of our cars) and 2) mortgage (as well as the value of our house). The main reason of not including these two items in the networth calculation is that I am not sure the market values of the cars and the house. Adding them to the equation may skew the result and give us a inflated number. Overall, the net change from July is $15,055, or about 4.25%.The month of August turned out to be a pretty good month in terms of the growth of our networth. We continued to contribute to our retirement accounts (401(k) and Roth IRA), taxable accounts, bonds, and college savings accounts as scheduled. Thanks to a generally good month of stock markets, we have some gains in our investments, as compared to July.

The major part of the credit card debts are balance transfers, which expire in December. Every month I paid a little bit more than the minimum requirements to stay good standing.

Started in August, I boosted our weekly purchase of the 4-Week T-Bill from $2000 to $3000. This contributes to the most increase in the bonds category. In addition, we also make $100 purchase of I-Bonds every month.

We parked our cash at EmigrantDirect, which earns us a 5.15% APY. In addition, we also have a small amount in HSBC, ING, and Virtual Bank. I keep monitor the interests of these banks and switch back and forth among them to get the highest rate. HSBC, which now has a 5.05% APR, is the one that I use to fund the T-Bill purchases and receive deposits from TreasuryDirect once the bills mature.

In our taxable accounts, we have a number of stocks, mutual funds, and ETFs. I dollar-cost-average in all the mutual funds, but not the stocks, at the beginning of the month as most dividend distributions are likely to be at the end of the month.

We have two 529 plans and one Coverdell ESA for our daughter. In addition to the monthly contributions to these three acounts, we also earn cash backs with our Upromise and Fidelity 529 reward credit cards, which are linked to the 529 plans.

Categories: Networth, Finance, Investing, Savings,

Technorati tags: Investing, Networth, Personal finance, Savings

Digg this! |

Digg this! |

Add to deli.cio.us |

Add to deli.cio.us |

Yahoo

Yahoo

0 Comments:

Post a Comment

<< Home