Buffalo Small Cap: Keep It Or Dump It?

BUFSX has been part of my taxable investment portfolio since the beginning of 2002 when I started to invest. Since then, I have been dollar-cost-averaging $100 into this fund every month and the fund's return was superior: 51.2% in 2003 and 28.8% in 2004.

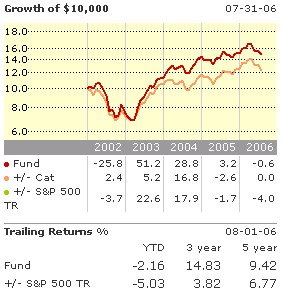

BUFSX has been part of my taxable investment portfolio since the beginning of 2002 when I started to invest. Since then, I have been dollar-cost-averaging $100 into this fund every month and the fund's return was superior: 51.2% in 2003 and 28.8% in 2004.However, the fund started to lag not only its peers, but also the benchmark since 2005, when it lost its one manager. Meanwhile, the total assets balloned to $1.6B, the size that becomes a burden for a small cap fund in finding quality companies to invest. On top of its size, the fund also has an expense ratio of 1.01%. Now, BUFSX is the worst performer in my portfolio.

I am a big fan of small cap funds and have owned several small cap funds in the past. At the beginning of this year, I trimmed my holds and now only have two: BUFSX and CGMFX. If I want to dump BUFSX, I need to find a replacement small cap fund and that won’t be an easy job after small cap has outperformed large cap for more than five years.

Digg this! |

Digg this! |

Add to deli.cio.us |

Add to deli.cio.us |

Yahoo

Yahoo

0 Comments:

Post a Comment

<< Home